< More news

Wetherspoon, its customers and employees have paid £6.1 billion of tax to the government in the last 10 years

The government needs taxes, but there should be tax equality between supermarkets and pubs, says Wetherspoon

•

Wetherspoons News

The government needs taxes, but there should be tax equality between supermarkets and pubs, says Wetherspoon

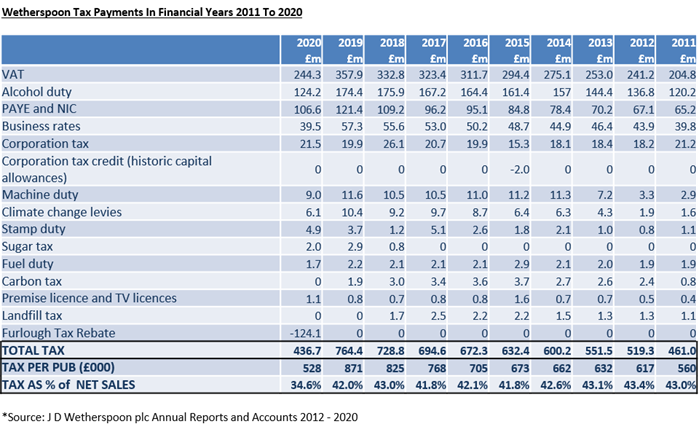

In Wetherspoon’s 2019 financial year (12 months to July 2019), before COVID-19, it generated £764.4 million in tax – about £1 in every £1,000 of ALL UK government taxes.

The average tax generated per pub in 2019 was £871,000. In the financial year ended July 2020, when pubs were closed for a long period, and the company made a substantial loss, £436.7 million of taxes were generated, net of furlough payments. The table* below shows the tax generated by the company in its financial years 2011–20. During this period, taxes amounted to about 42 per cent of every pound which went ‘over the bar’, net of VAT – about 11 times the company’s profit.

Wetherspoon’s finance director, Ben Whitley, said: “Pub companies pay enormous amounts of tax, but that is not always well understood by the companies themselves or by commentators, since most taxes are hidden in a financial fog. “Wetherspoon has provided a table which illustrates the exact amounts of tax which the company, its customers and employees have generated, highlighting the importance of the hospitality sector to the nation’s finances.

“Wetherspoon understands the need for taxes, yet, like the hospitality industry generally, believes that there should be tax equality among supermarkets, pubs, restaurants and similar businesses. “Until recently, supermarkets have paid zero VAT on food sales, whereas pubs, restaurants and hotels, for example, have paid 20 percent. The chancellor, Rishi Sunak, announced a temporary reduction last summer to five per cent VAT for pub and restaurant food sales, but the government intends to revert to 20 per cent this year. “Pubs also pay about 20p a pint in business rates, whereas supermarkets pay only about 2p.

“It’s quite wrong that dinner parties in Chelsea, for example, pay zero VAT for food bought from supermarkets, when pub customers normally pay 20 per cent VAT for fish and chips. “Equality and fairness are important principles of efficient tax régimes, and we urge the government to introduce equality in this area – sensible tax policies will increase investment and government revenues.”